Inventory hit another yearly high. The last time inventory in the Single Family market was this high was back on August 10th of 2020. The condo market also hit another inventory high. Inventory high. Inventory high. Inventory high. I hope buyers are hearing this. Because it’s not going to last for long.

There are some great opportunities out there for buyers to swoop up a deal. You just need to know where to look.

Get An Offer Today, Sell In A Matter Of Days

In this blog posting we will go over the Single-Family and condo markets in the state of Massachusetts. And we will also do an interest rate update plus we will talk about some relevant current events.

Hi I am Jeff Chubb – A recovering Investment Banker turned real estate investor that now focuses my attention on a We Buy Houses in Massachusetts company. I have been involved in more than a 1,000 transactions. If you have any questions about the real estate market, then know I am here to help.

Let’s jump into the Single-Family market stats.

I know I said it last week. But anything good is worth repeating, right? Check out the continued spike in inventory.

The inventory levels in the Single Family market hit 5,808 units. We now have 16.9% more homes on the market than 28 days ago. As I mentioned, the last time we had this amount of inventory was on August 10th in 2020 when we had 5,808 homes on the market! We should see about another month of Inventory increases until we start the Fall drawdown.

Buyers looking to buy this Fall… This should be like Mozart to your ears. Seller’s looking to sell using a We Buy Houses Massachusetts company then this is great news.

We continue to see our inventory levels grow over the previous years.

We now have 1,371 more houses on the market when compared to the same week last year. And now have 402 more houses on the market when compared to 2022.

New Listings continue to decline, but continue to be over the levels of 2023 and 2022. We listed 1,214 single family houses last week which was 197 additional houses than when compared to the same week in 2023! New listings activity increased by 19.4% this week.

The 4 week rolling average is 1,066 units.

Under agreements also came in higher. And are spiking a bit. Could this be thanks to the lower interest rates? This week we put 1,041 Single family homes under agreement. This is 160 units or 18.2% more than the same week last year when we put 881 homes under agreement.

The four week rolling average is 889 units.

So when compared to last year’s market… New listings were up by 19.4% while under agreements were up by 18.2%. Keep in mind that these stats do not include off-market stats. Many of the houses we buy and sell with our We Buy Houses Massachusetts company are done off market and would not show up in these numbers.

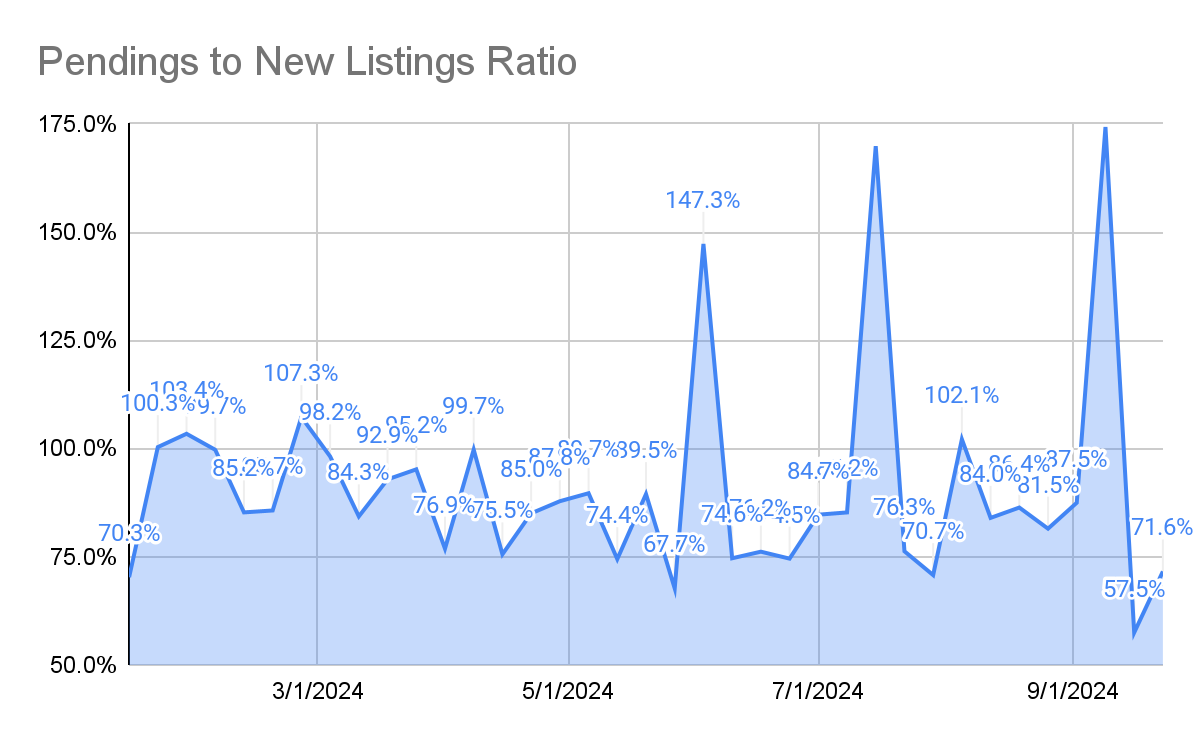

This Pendings to New Listings ratio is leveling out. The ratio of 77.8% is compared to the 90.1% that we saw this week last year. What this means is that nearly 78% of all the properties that came on the market two weeks ago went under agreement last week.

There were 625 Single Family homes that closed last week for an average sales price of $757 thousand dollars and a median sales price of $623 thousand dollars. Sales levels compared to the same week last year were up by 72 units or 13% as there were 553 Single Family homes that sold this week last year for an average price of $769k.

Months of inventory. This is how we determine what type of market we are in. 0 to 5 months is considered a sellers’ market with the closer to 0 you get… The more aggressive a seller’s market.

This week’s Months of inventory increased to 1.77 months from last week’s 1.72 months. The 1.77 months this week is compared to the 1.42 months this week last year. The gap between this year and last grew to .35 months.

In other words, the market improved for buyers.

Real quick, my shameless plug… I just wanted to mention that if you are look for someone to We Buy Houses in Massachusetts, then it would be a true pleasure to help!

Now onto the Condo market… We now have 3,144 condos on the market as of Monday.

This means that there is 16.9% more inventory on the market today than the inventory levels on the market just 28 days ago. This was the highest that inventory has been since I started keeping records in the condo market.

We now have 641 more units on the market today than today last year. 357 more than compared to the inventory levels of 2022 and 77 more units than in 2021.

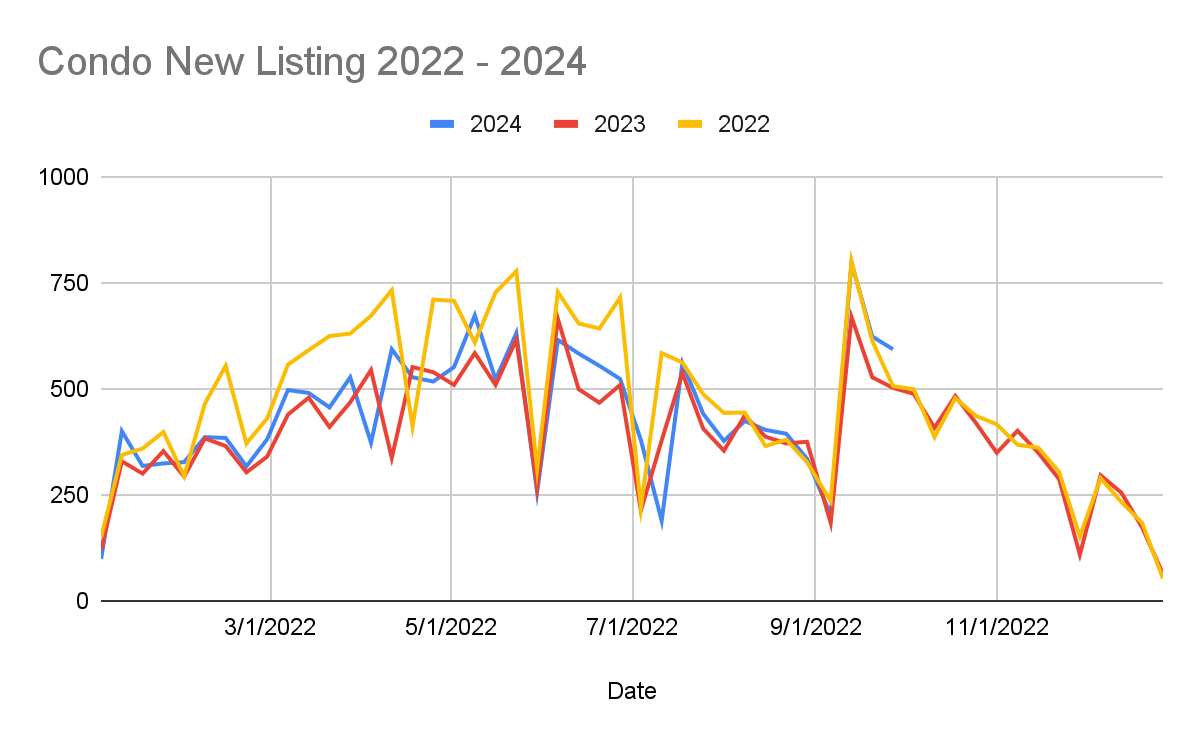

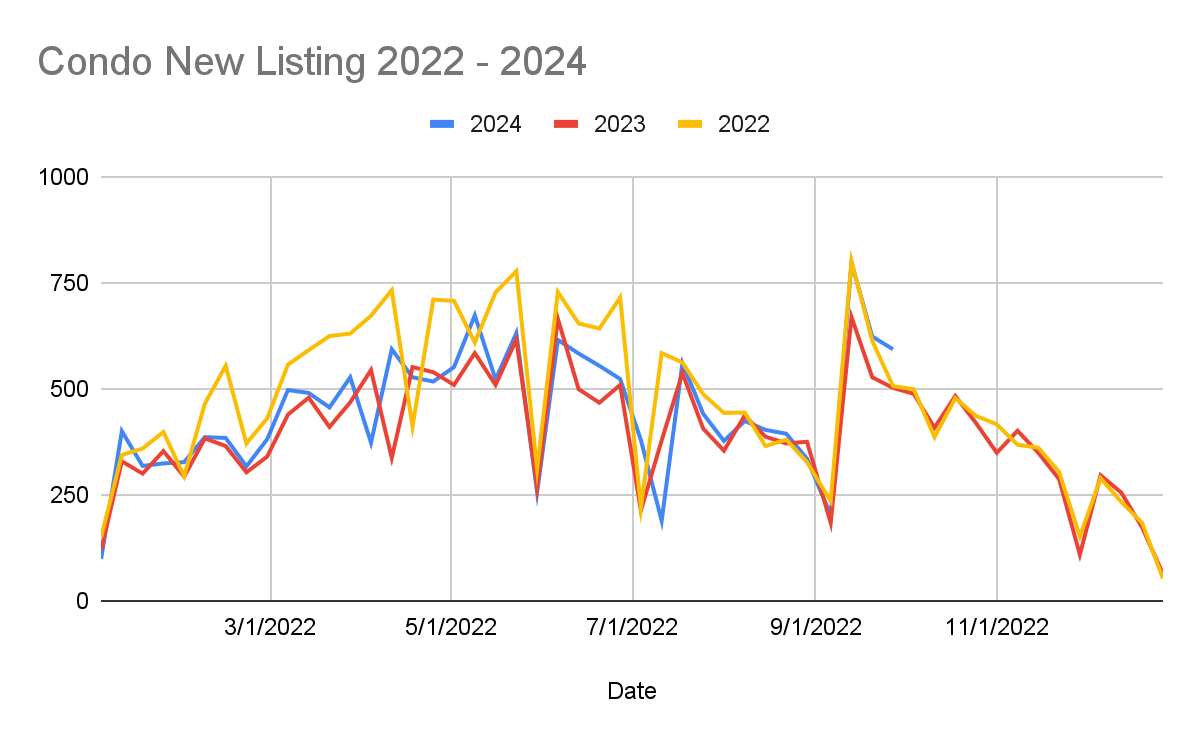

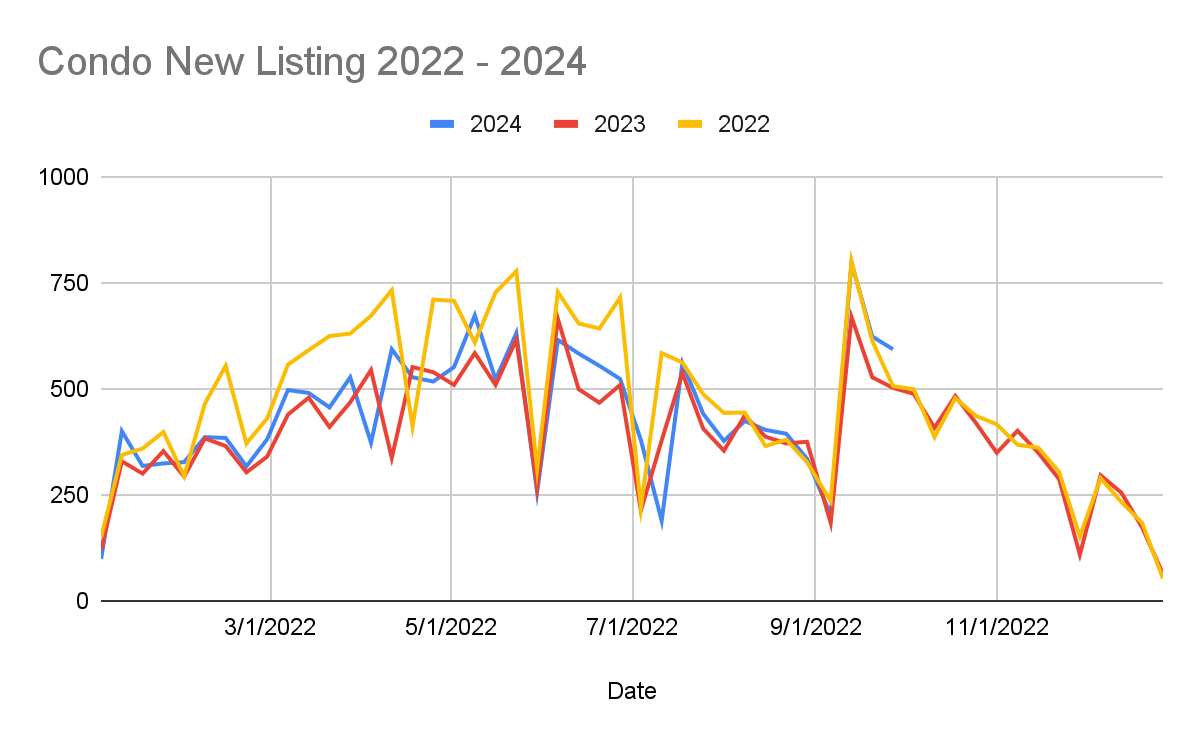

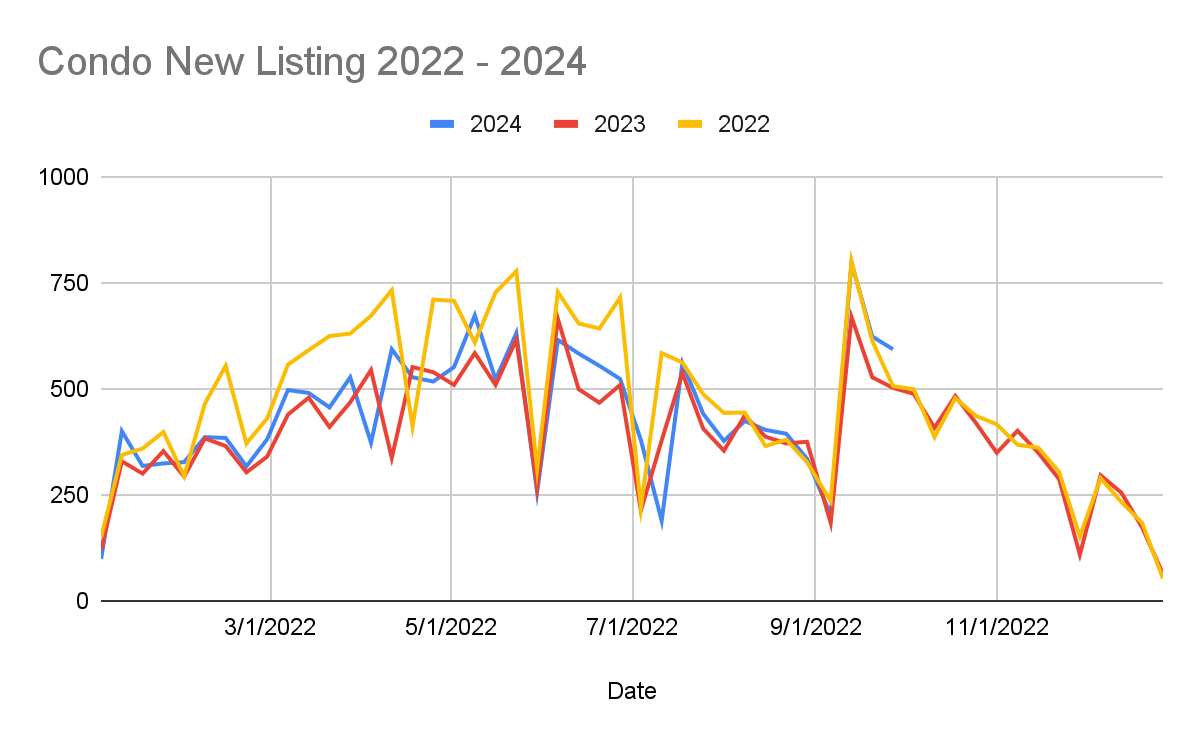

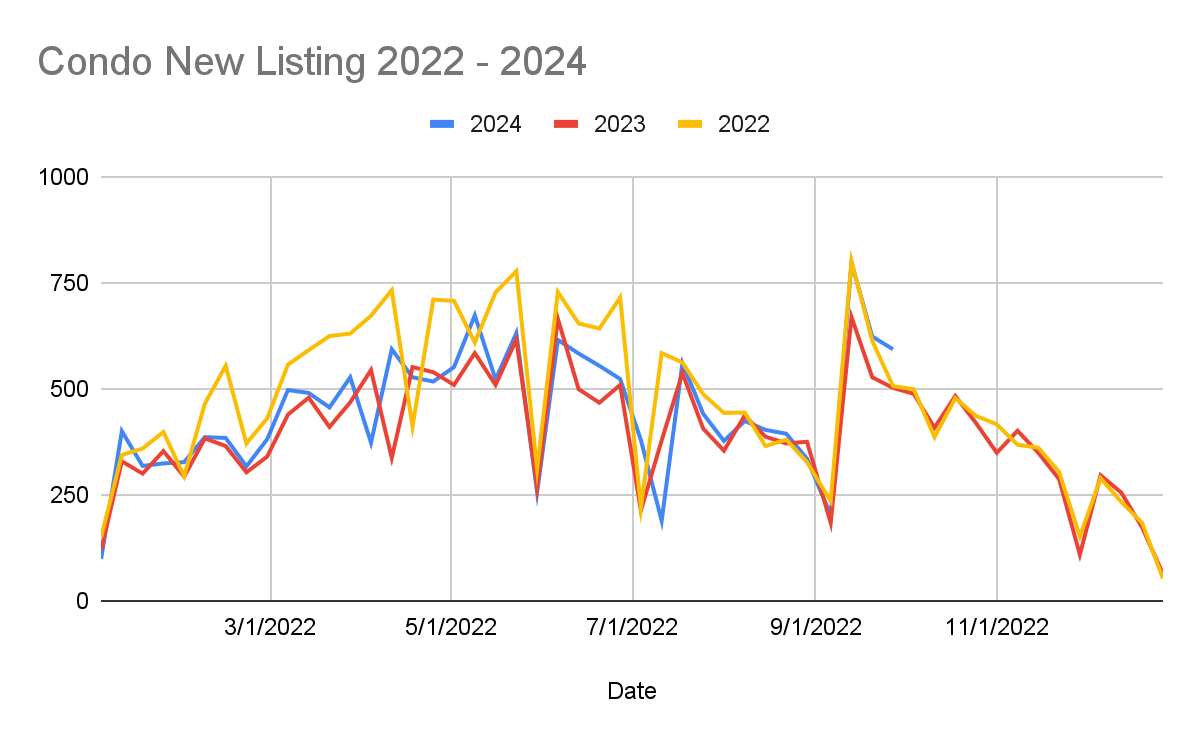

There were 593 condos that came on the market last week with the four week rolling average of 489 units.

The 593 units listed was 91 units or 18.1% more than the 502 condos that came on the market the same week in 2023. What’s interesting is that we broke away from the 2022 trend a little bit. Something to keep our eyes on in the coming weeks.

This week we put 446 units under agreement. This 446 condo sales is 38 units or 9.3% more than the 408 condos that we put under agreement this week last year.

The four week rolling average for under agreements is 356 units.

So 18.1% more listings came on the market when compared to this week last year while selling 9.3% more condos. The interesting thing is that if you are looking to sell my house fast Boston, then using a We Buy Houses Massachusetts company would be the quickest way to do it.

Just like the Single Family market, The condo Pendings to New Listing seems to be leveling off. This week’s pendings to new listing ratio is 71.6%. This is compared to the 77.4% that we saw this time last year.

There were 240 condos that sold this week for an average sales price of $659 thousand dollars and a median sales price of $515 thousand dollars. This same week last year there were 231 condos that sold with an average price of $619 thousand dollars. So sales levels were up by 3.9%.

Months of Inventory increased to 2.36 months this week compared to the 2.29 months that we recorded last week. We recorded 1.89 months of inventory levels this week last year. The year over year inventory level spread increased to .48 months.

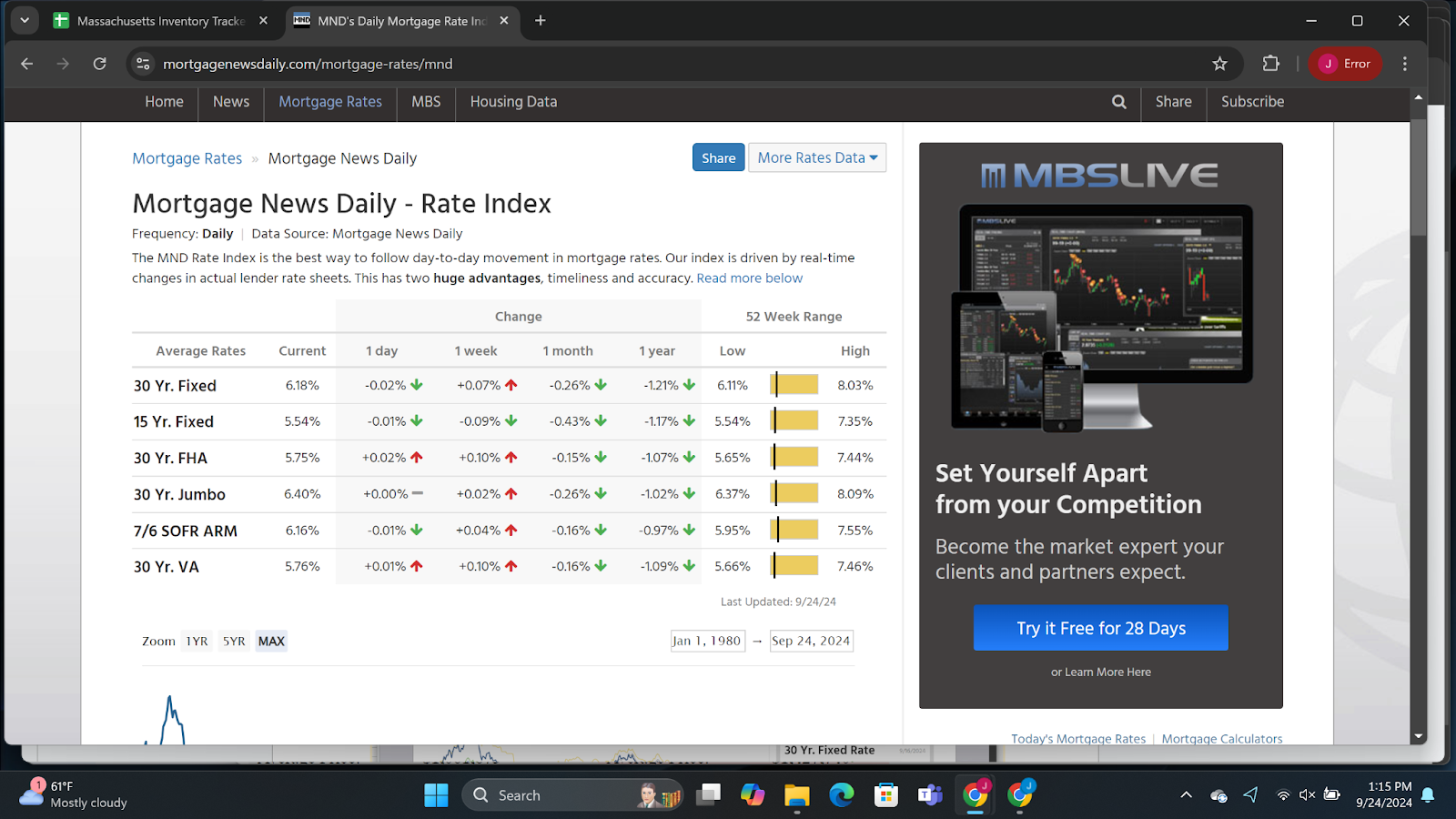

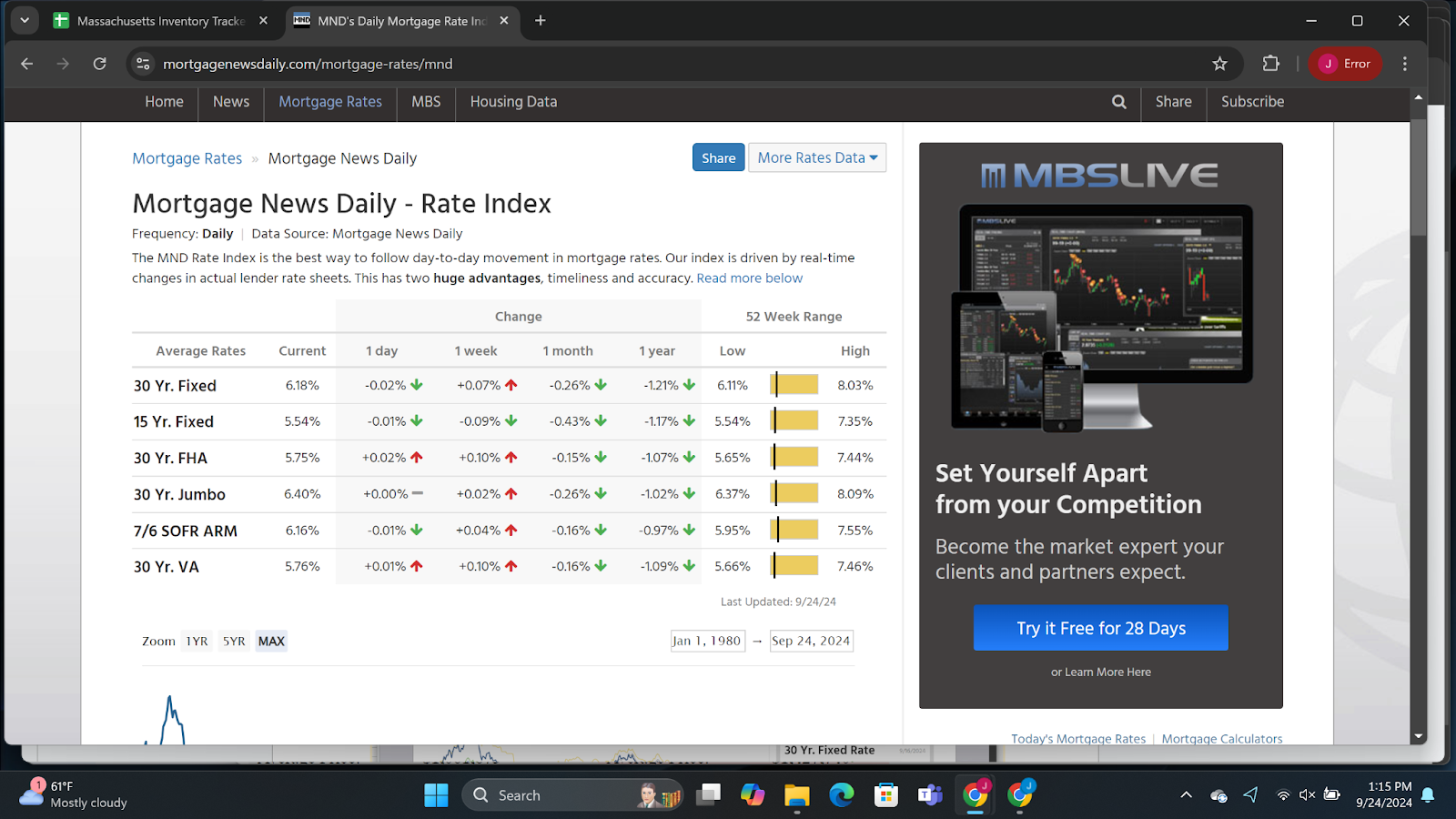

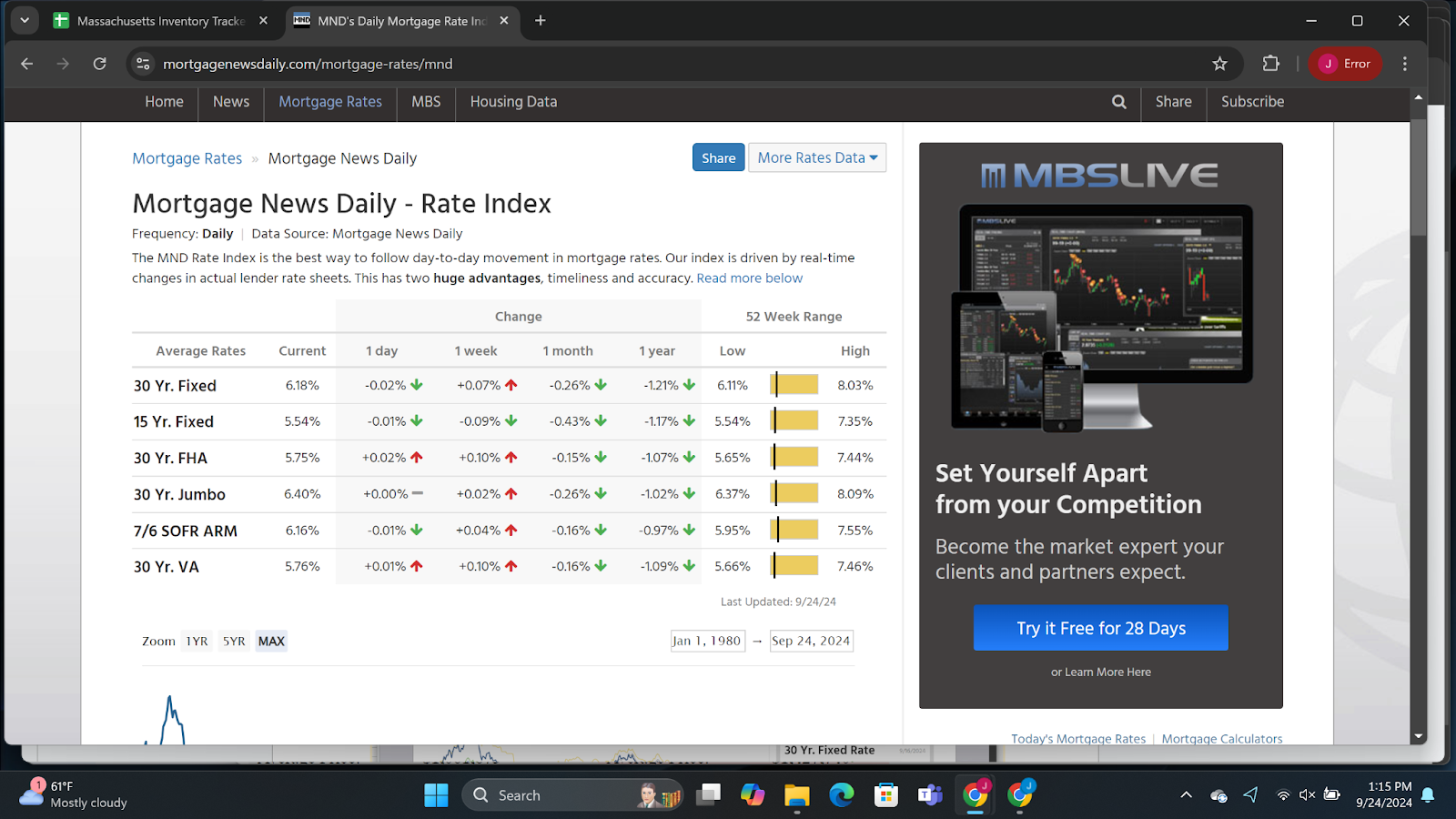

Time to talk about Interest rates… Because they matter… They matter to consumers, but also to investors like We Buy Houses Massachusetts companies.

Interest rates ticked up a bit last week. Wait. What? Interest rates tick up when the FED funds rate goes down?

The Federal Funds rate and the mortgage rates are not tied to one another. Just because one goes down doesn’t mean the other will in the same amount. Think about it this way for a second. If they were tied to one another then interest rates wouldn’t move in between FED rate decisions.

And this is because the FED rates are tied to the 10 year treasury.

Let’s first talk about consumer confidence. Or maybe it is a lack there of.

The consumer’s confidence slipped to 98.7 from last month’s 105.6. This was the biggest one month decline since August 2021.

To put this number in contrast. In February of 2020, the last month before Covid, the Consumer confidence was 132.6. On the expectations measure, a reading below 80 is consistent with inflation.

I just want to put these numbers into what I think is the perspective. It’s an election year. It almost becomes impossible to ignore all the negative narratives that come out of both sides.

Also, the FED did just cut 50 basis points. I feel like such a draconian cut probably would eat into people’s confidence in the economy.

By the way, in my opinion 50 basis points was too much. They should have done 25. They are signaling to the world that things are worse than they really appear. But my big thing. I heard the stat the other day that we have seen another surge in inflation 85% of all the times where inflation has gone above 6%. In other words there is an 85% chance that we will see a jump in inflation. And I personally don’t think the 50 basis point decrease will help those 85% chances.

Keep in mind, these are the same people that told us for so long that the inflation we were all living was transitory.

Want to talk about your personal real estate needs? Want to sell my house fast Boston? Keep in mind that We Buy Houses Brockton to We Buy Houses Lowell to We Buy Houses Worcester to We Buy Houses Cape Cod. We are investors and offer seller’s cash offers and buy their house in as-is condition.

Again, it’s Jeff Chubb. Whether you are sell my home fast like in the next 9 days or need a little more time and sell in the next 90 days, then I would love to chat with you and find out about your real estate goals. Reach out by calling or emailing or filling out the form below.