Table of Contents

- How Accurate Is the Zillow Zestimate? Insights from a Massachusetts Cash Home Buyer (#introduction)

- Why Zillow Zestimates Change on a Whim (#zestimate-changes)

- Does the Zillow Zestimate Make Sense? Real Examples (#real-examples)

- Zillow’s Failed House Buying Venture and Zestimate Adjustments (#zillow-venture)

- Understanding Zestimate Accuracy and Limitations (#zestimate-limitations)

- Better Alternatives for Selling Your Home in MA (#alternatives)

- Frequently Asked Questions About Zillow Zestimates (#faqs)

- Conclusion: Stop Relying on Zillow Zestimates (#conclusion)

Introduction

We have all done it and most likely multiple times… Checking out our “Zestimate” on Zillow to get an idea of what our house value is. I mean, Zillow knows best, right? No. The Zillow Zestimate can be awfully inaccurate… And shortly I am going to show you an exceptional example as to why.

It’s gotten so bad that when I sold houses, I would check the Zestimate out after I had done all the comp work. Why? Because there was a near certain chance that knowing that number, meant that I knew the number that was anchored in the seller’s head.

Get An Offer Today, Sell In A Matter Of Days

Why Zillow Zestimates Change on a Whim

If the Zestimate was so secure, then why does it change the moment that a house is listed? Recently our company, Bluefin Property Buyers which is one of the top home buying companies in Massachusetts put a house up for sale in Holbrook, MA for $550,000.

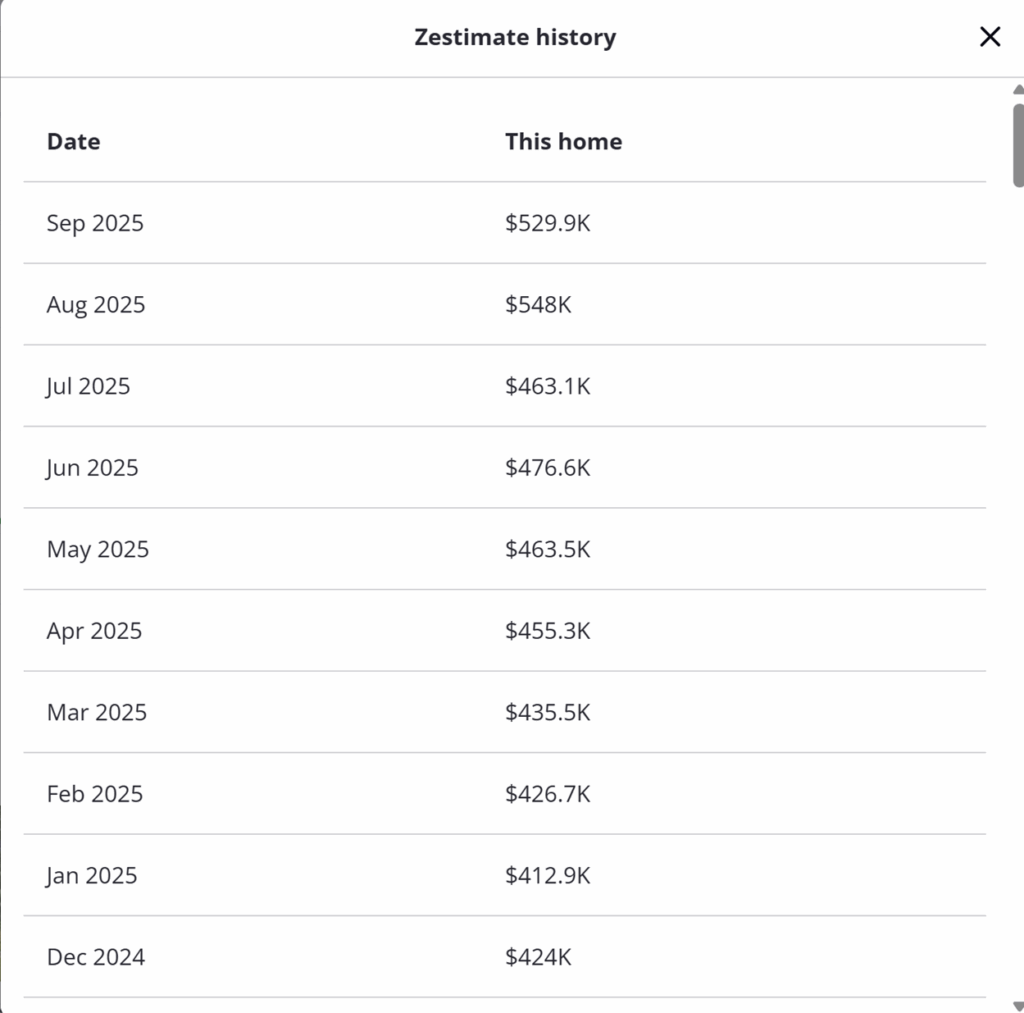

Why does that matter? It matters because the house’s Zestimate was $463,100. Zillow’s Zestimate then jumped to $548,000 the moment after we listed it for sale. If Zillow’s Zestimate was so exact, then how… Why could it jump by over $80 thousand in a matter of a day.

The house didn’t sell at $550,000. So we reduced the price down to $529,900. Want to take a guess at what happened to the Zestimate? The Zestimate immediately decreased to…. Drum roll please… $529,900.

Take a look at the Zestimate for the We Buy Houses Holbrook home purchase. The valuation was all over the place even before we listed the house for sale.

Does the Zillow Zestimate Make Sense? Real Examples

How about this scenario? Two attached Single-Family properties. Literally, the two properties are attached so their location is identical. The properties are the exact same square footage. The houses are the exact same number of bedrooms and baths. And they even last sold for approximately the same price and around the same time.

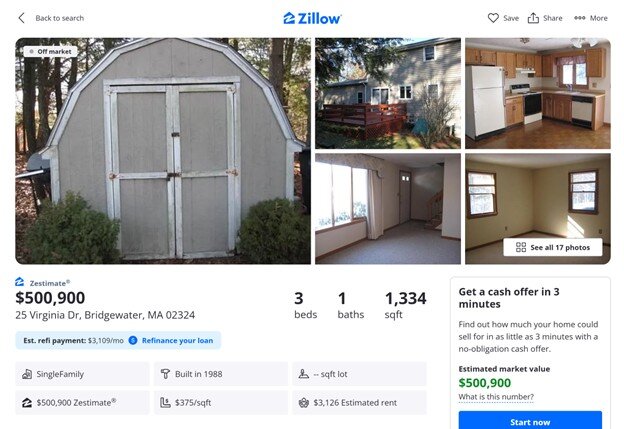

Bluefin Property Buyers went under contract on a house in Bridgewater, MA. Unique situation as the house was in foreclosure. But it wasn’t a person in foreclosure. It was an estate. The owner had passed away.

The Zillow Zestimate came back at $500,900.

As you can see, the house is 3 bedrooms, 1 bath and spans 1,334 square feet.

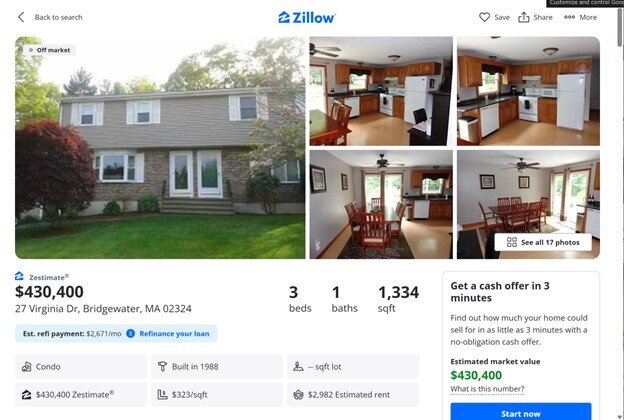

The exact house next door had a Zestimate of $430,400. And you can see that the specs of the house are the exact same.

Normally one of the calculations that goes into a Zillow Zestimate is the length of ownership with the compounding area appreciation rate.

This makes sense after all.

The house at 25 Virginia last sold on 11/27/2012 for $210,000.

The house at 27 Virginia last sold on 11/7/2013 for $197,000.

So, they sold one year apart for a $13,000 difference. And this is now equating to a $70,500 difference. Again. For the exact same property. And yes, the properties were in very similar condition when they were last sold.

Zillow’s Failed House Buying Venture and Zestimate Adjustments

At one point, Zillow decided to get in the house buying game. They failed miserably as they couldn’t compete with local house buying companies like Bluefin Property Buyers.

What’s crazy is that they had a HUGE competitive advantage against us local Massachusetts House Buying companies like Bluefin Property Buyers.

Zillow had the #1 Real Estate Website in the country. And it’s not even close. As of this writing, they were #1 with 50 to 60% of all real estate views with the roughly 254 million monthly views. Realtor.com is their next competitor with 80 to 100 million views. Trulia, which Zillow owns is #3 with 40 to 50 million views. Redfin has about 30 to 40 million views while Homes.com sits at 20 to 30 million views.

Zillow isn’t just dominant. They kick back side and take names.

Why does that matter? Because it should really give you an idea of what their competitive advantage should have been in the Fast Home Selling space.

Zillow didn’t just enter the We Buy Houses market in the entire country. They went market by market. In the end, they ended up cutting the program pretty quickly as they didn’t end up in all the markets in the country.

Here is what is interesting and very important to know when you factor in how accurate your Zillow Zestimate is. As Zillow was entering markets with the intention of buying houses, they actually went through and DECREASED the Zestimates in those areas.

When their money was on the line… They realized that they needed to come back down to reality on house value estimates.

Understanding Zestimate Accuracy and Limitations

Zillow’s disclosure for Zestimate accuracy provides a median error rate which indicates the range within which half of Zestimate fall compared to actual sale prices. For off-market homes, the median error rate is +/- 7%. In other words, they give themselves a 14% spread in accuracy. That’s a big number!

Better Alternatives for Selling Your Home in MA

If you are looking to sell a property and want to maximize your price, then there is little doubt that selling the traditional way of hiring a real estate agent, staging the house and then putting it on the market. Dealing with the showings and the possibility of the deal falling through is all worth it.

If you are looking to take the easy way out when it comes to selling your property, then selling to a We Buy Houses Massachusetts company like Bluefin Property Buyers could be the way to go. Yes, you give up some value, but you get exceptional terms. Terms like buying the house for cash and as-is condition. Choosing which closing date works best for you while leaving anything behind that you don’t want to take.

Reach out with questions… And stop depending on the Zillow Zestimates.

Frequently Asked Questions About Zillow Zestimates

- How accurate is the Zillow Zestimate for my home?

The Zillow Zestimate has a median error rate of 1.83% for on-market homes and 7.01% for off-market homes, meaning half of estimates are off by more than these percentages. Accuracy varies by location and data quality, so it’s not a substitute for a professional appraisal. - Why does my Zillow Zestimate keep changing?

Zestimates fluctuate due to updates in listing status, recent sales data, or market trends. For example, a Holbrook, MA home’s Zestimate jumped from $463,100 to $548,000 upon listing, reflecting Zillow’s reliance on real-time inputs. - Is the Zillow Zestimate better than Redfin’s estimate?

Zillow’s median error rate (1.83% on-market) is slightly better than Redfin’s (~1.9%), but both automated valuation models struggle with unique properties or sparse data areas like rural Massachusetts. - What are the limitations of the Zillow Zestimate?

Zestimates may miss unreported renovations, unique property features, or local market nuances. They rely heavily on public records and comps, leading to errors like a $70,500 gap for identical Bridgewater, MA homes. - Can I trust the Zillow Zestimate when selling my home?

No, Zestimates are not reliable for final sale decisions. They’re a starting point, but a real estate agent’s comparative market analysis or a cash offer from a company like Bluefin Property Buyers provides more accuracy. - How can I sell my house fast in Massachusetts without relying on Zestimates?

Selling to a cash home buyer like Bluefin Property Buyers offers a quick, as-is sale with no appraisals or showings, ideal for homeowners all throughout MA including Holbrook or Bridgewater, MA. - Why did Zillow lower Zestimates when buying houses?

During its iBuying program, Zillow reduced Zestimates in target markets to align with realistic purchase offers, admitting their estimates were often inflated compared to actual market values.