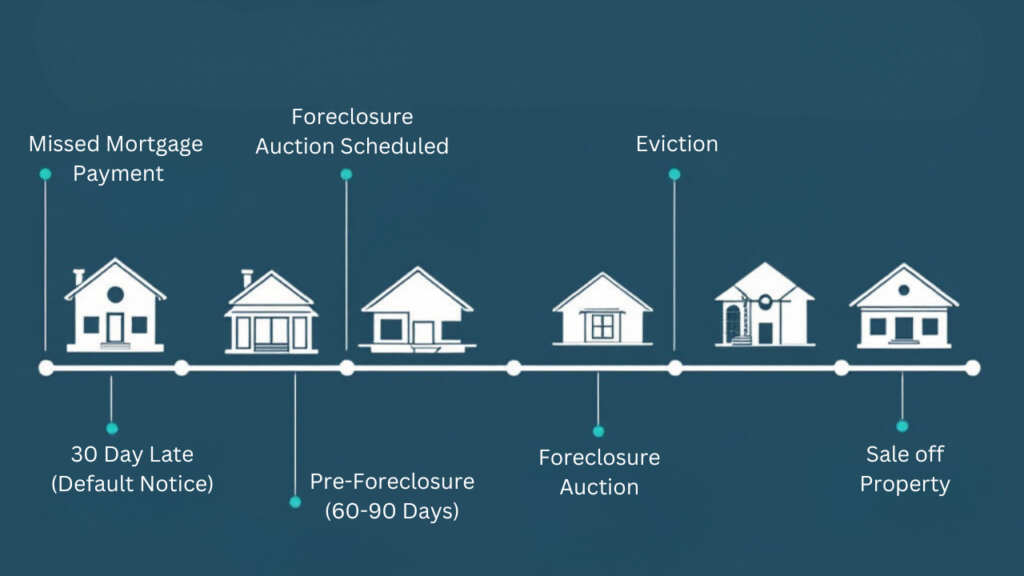

So, you have a friend or family member that has a home that will be foreclosed on in the next 10 days… What are their options? And what do their options look like if they have a little more time?

These are tough times with more and more people falling behind and going into foreclosure.

While I have not ever been in foreclosure, I have personally been through those rough times. When the credit card bill kept growing and growing. What did I do? Exactly what I shouldn’t have. When that bill came in the mail, I stayed the heck away. I wouldn’t open it. I would basically hide under my couch.

And folks hiding under the couch is what we see a lot when someone misses their mortgage payment and it doesn’t get any better when the bank starts communicating that they are in foreclosure. They are tough times.

The foreclosure process becomes very real when the bank sets the foreclosure auction date. This is when I hear from a lot of people looking for help and asking about their options.

But unfortunately, at this point there are not many options available to a homeowner at this point of the game. But let’s go over them and what I would be doing.

The first thing I would do is call the bank. Now if you call the bank to say that I need more time because I don’t want to lose my house, then they are not going to give you more time.

But if you call the bank and offer them a solution, then they may grant you more time. So, what type of solution are you calling them with? Maybe that solution is that you have started the process of a modification. Now I will say that the pushing off the foreclosure date for a modification is rare. Banks want to see more of a definitive action.

So, what type of definitive action are they really looking for? They want to see that the house is going to be sold. There are some banks that will delay a foreclosure with a listing agreement and proof that the house is actively being marketed for sale. At the end of the day, a bank doesn’t want to foreclose on a property. There is risk and a lot of headaches to a bank once the property has been foreclosed on as the process of divesting the asset is now up to them. And a lot can happen between the time that the house has been foreclosed on to when it has been sold. If they can, they would love to mitigate that risk!

The most likely way to get a bank to delay a foreclosure is to come to them with a contract between the property owner and a buyer. When a bank sees a contract, then they know there is a probable end in sight and that they will be able to clear this liability off their balance sheet while also being able to assume less risk throughout the process.

A question I get all the time is, “I want to stay in the house, so what are my options?”. Essentially you have three options at this point. The first is to pay off the delinquent balance to put the mortgage in good standing. This is unrealistic for most. This can be done up until moments of the actual foreclosure auction.

The second option is to do a modification. But here is the catch. If you can’t afford the house after the modification, then no bank is going to grant a modification or push off a foreclosure date.

So what do I mean by this? A common circumstance for someone falling behind is because they have lost their job. If you apply for a modification with no income because you haven’t found a new job or you apply for the modification with a job that is paying less, then a bank is not going to grant a modification.

To say it another way, if a bank feels that there is little to no chance for success and that granting a modification is just going to kick the proverbial can down the road, then they aren’t going to do it.

The third option is filing for bankruptcy. This can ultimately temporarily halt the foreclosure process. Chapter 13 bankruptcy allows you to restructure your debts and may give you time to catch up on your mortgage payment. In most cases if there hasn’t been a change to a homeowner’s financial situation, then they will ultimately force the sale of the property anyway. This process will also end up costing homeowners a great deal of money paying for a bankruptcy attorney to take you through the process. A bankruptcy will also stay on your credit report longer than a foreclosure as a bankruptcy remains on a person’s credit report for 10 years. This is a very significant financial decision that requires a lot of consideration and a great deal of legal advice.

There are many positives to selling a house in order to not be foreclosed on. The biggest one is cashing in on your own hard-earned equity. By selling the house, you are ensuring that the bank won’t steal it. Selling the property and avoiding foreclosure ensures that your credit will not be as badly affected. A foreclosure stays on your record for 7 years. Missed payments will be off of your credit report within 3 years. And you will see a major bounce back on your credit score within two years.

This helps ensure that your future borrowing costs are less. Nearly every financial application has the question “have you ever been foreclosed on”. The moment you check this disclosure box, you are automatically thrown into a higher credit risk profile and thereby a higher borrowing rate.

When you need to sell fast within two or three weeks of a foreclosure date then your options also become more limited.

The best thing to do is reach out to an agent right when the foreclosure process starts and put the house on the market at that time. A homeowner has more time and can go through the traditional sale process. By doing this, they are able to obtain a higher market value offer on the house and ultimately net a higher amount of proceeds.

Essentially the only option you have for a quick sale when you have only weeks before your foreclosure date is to sell to a investor. You need a cash buyer. Think a We Buy Houses type of company.

There are many companies and investors out there that can help you sell my house fast as they buy houses with cash and close quickly. I personally own a company, Bluefin Property Buyers that buys houses for cash in as-is condition. This means that homeowners can sell their property without having to do repairs and deal with the hassles of showings. It is true that cash investors do not pay what people would consider full retail price, but in this situation, something may just be better than nothing.

Hey, it’s Jeff Chubb, I have sold more than a thousand houses. If you have questions about the foreclosure process or are looking to sell your house fast, then please feel free to reach out to me at Jeff@BluefinBuyers.com or by filling out the form below.